The AI boom isn’t powered by magic — it’s powered by data centers, GPUs, and server racks. Behind every chatbot, self-driving car, and generative AI model is an infrastructure arms race to deliver faster, smarter compute.

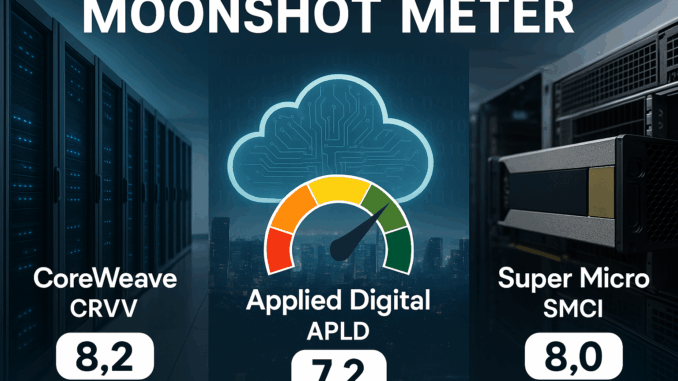

Today, we’re putting CoreWeave (CRWV), Applied Digital (APLD), and Super Micro Computer (SMCI) on the Moonshot Meter to see who’s building the foundation for the next decade of artificial intelligence.

☁️ CoreWeave (CRWV)

Overview:

CoreWeave is a newly public AI cloud compute company specializing in GPU-based infrastructure. Once a crypto mining operation, it has successfully pivoted into one of the fastest-growing cloud providers for AI workloads — competing with the likes of AWS and Azure, but with NVIDIA’s direct support and partnerships.

Moonshot Scores:

– Tech Breakthrough Potential: 9/10 – GPU-first cloud architecture optimized for AI.

– Market Opportunity: 10/10 – The AI compute market is expanding exponentially.

– Commercialization Timeline: 8/10 – Already serving top AI model developers.

– Balance Sheet & Risk: 5/10 – High capital intensity and scaling costs.

– Moonshot Torque: 9/10 – Fresh IPO status means massive room to grow.

Final Moonshot Score: 8.2/10

Verdict: ☁️ High-Conviction Moonshot – The newest public player in AI cloud compute, backed by real demand and real growth.

⚡ Applied Digital (APLD)

Overview:

Applied Digital started as a crypto hosting provider but has since transitioned into building AI-optimized data centers across North America. With recent contracts for GPU hosting and HPC workloads, APLD is a speculative but promising moonshot in the infrastructure pivot trend.

Moonshot Scores:

– Tech Breakthrough Potential: 7/10 – Smart pivot from crypto to AI data services.

– Market Opportunity: 8/10 – AI workloads driving record data center demand.

– Commercialization Timeline: 7/10 – Hosting contracts expanding but still early-stage.

– Balance Sheet & Risk: 5/10 – Small cap, high debt load from infrastructure buildouts.

– Moonshot Torque: 9/10 – High-risk, high-reward microcap with AI exposure.

Final Moonshot Score: 7.2/10

Verdict: ⚡ Speculative Torque Play – Risky but well-positioned in the AI data center buildout boom.

🖥 Super Micro Computer (SMCI)

Overview:

Super Micro is the hardware engine of the AI revolution — designing and assembling GPU server systems for NVIDIA, AMD, and major hyperscalers. Unlike many peers, SMCI is profitable, growing fast, and already shipping the backbone of generative AI infrastructure.

Moonshot Scores:

– Tech Breakthrough Potential: 8/10 – Advanced modular server architecture.

– Market Opportunity: 9/10 – Demand for AI GPUs is exploding.

– Commercialization Timeline: 10/10 – Fully commercial, scaling rapidly.

– Balance Sheet & Risk: 8/10 – Profitable with strong growth trajectory.

– Moonshot Torque: 5/10 – Large-cap limits torque, but still massive upside if momentum continues.

Final Moonshot Score: 8.0/10

Verdict: 🖥 Established Innovator – The most proven AI hardware company, bridging moonshot innovation with real earnings.

🧠 Why This Matters

The next wave of AI winners might not make the models — they’ll power the machines that run them.

AI infrastructure is the digital equivalent of oil pipelines — whoever builds them controls the flow of intelligence.

📝 Takeaway

CoreWeave (CRWV): ☁️ High-Conviction Moonshot — GPU cloud pioneer

Applied Digital (APLD): ⚡ Speculative Torque Play — data center upstart with high potential

Super Micro (SMCI): 🖥 Established Innovator — the hardware powerhouse of the AI age

From GPU clouds to data centers to the servers themselves — these three companies are building the AI economy’s backbone.

Be the first to comment