In the shadowy world of short-selling, few things rattle traders more than the threat of a short squeeze. And in July 2025, the list of stocks with short interest over 20% is longer—and more volatile—than ever. From tiny low-float penny stocks to battered large-cap companies, these names are being stalked by both hedge funds and meme-stock vigilantes alike.

Today, we break down the most heavily shorted stocks trading in U.S. markets, with short interest north of 20%. Whether you’re a contrarian investor or a squeeze chaser, these stocks are worth watching.

🔥 What Is Short Interest and Why 20% Is a Key Threshold

Short interest represents the percentage of a company’s float (publicly traded shares) that has been sold short. When this number climbs above 20%, it suggests that a large chunk of traders are betting on the stock to fall.

That much pessimism can create a combustible situation. If the stock starts to rise—even slightly—it can force short sellers to buy back shares quickly to cut losses. That “short covering” can send prices soaring, leading to the legendary short squeezes seen in names like GameStop and AMC in years past.

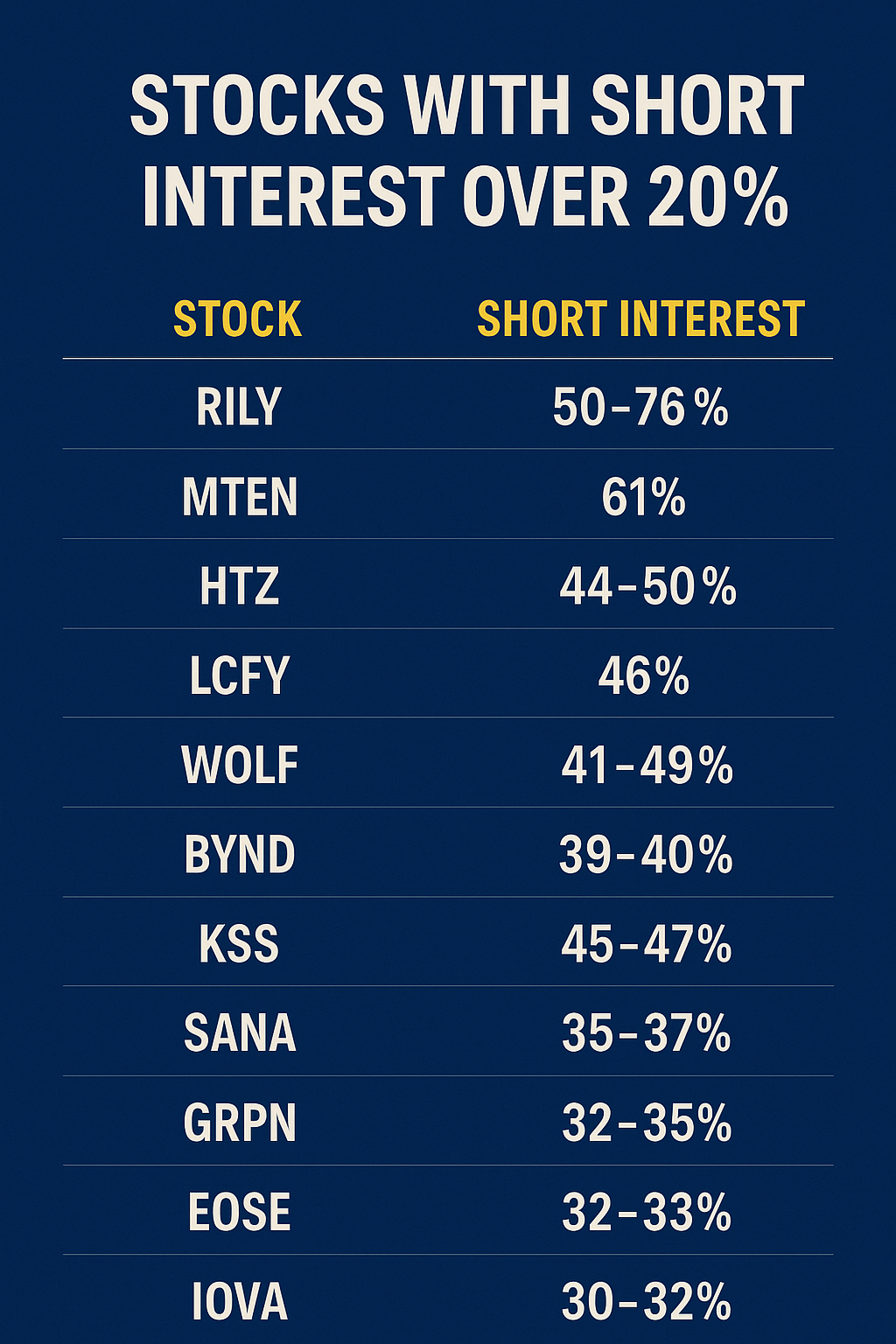

Top Stocks With Short Interest Over 20% – July 2025

Here’s a hand-picked list of U.S. stocks with short interest above 20%, based on recent exchange data and analyst tracking:

🚀 Short Interest Over 40%

| Ticker | Company | Short Interest | Float (approx.) | Highlights |

|---|---|---|---|---|

| RILY | B. Riley Financial | 50–76% | ~16M | Huge short vs. small float |

| MTEN | Mingteng Intl Corp | 61% | ~2.3M | Micro-float name |

| LCFY | Locafy Ltd | 46% | ~1.4M | Low-float + high squeeze risk |

| KSS | Kohl’s Corp | 45–47% | ~110M | Meme stock resurgence |

| HTZ | Hertz Global | 44–50% | ~130M | Downtrend fuels shorts |

💣 Short Interest Between 30–40%

| Ticker | Company | Short Interest | Highlights |

|---|---|---|---|

| BYND | Beyond Meat | 39% | Squeeze watchlist regular |

| SANA | Sana Biotech | 36% | Biotech volatility |

| GRPN | Groupon Inc. | 34% | Low float, high pressure |

| EOSE | Eos Energy | 33% | Energy sector squeeze candidate |

| IOVA | Iovance Biotherapeutics | 31% | High float + high interest |

⚠️ Short Interest Between 20–30%

| Ticker | Company | Short Interest | Notes |

|---|---|---|---|

| PLUG | Plug Power | 22–24% | EV & battery stock under fire |

| CHPT | ChargePoint | 21–25% | Clean energy bear target |

| MVIS | MicroVision | 22–27% | Squeeze rallies frequent |

| BLNK | Blink Charging | 25–27% | Meme stock potential |

| SOUN | SoundHound AI | 34% | AI stock with heavy shorts |

| INDI | Indie Semiconductor | 30% | Small-cap semi pressure |

⚡ Why These Stocks Are on Watch

- Low floats like MTEN, LCFY, and GRPN can spike fast on any news.

- Consumer names like BYND, KSS, and HTZ are being targeted as they continue to underperform in earnings.

- Tech and biotech names like PLUG, SANA, and SOUN are often volatile and sentiment-driven—ideal setups for squeezes.

🧠 Trading Tips for Heavily Shorted Stocks

- Watch the news – Earnings, upgrades, or even tweets can trigger squeezes.

- Check days-to-cover – A high short interest with high days-to-cover is especially combustible.

- Use stop-losses – These stocks can move sharply in both directions.

- Consider volume and float – A low float with surging volume is often the start of a squeeze.

🎯 Final Thoughts

Whether you’re betting with the bears or looking to squeeze them out, short interest over 20% is a red flag—or a green light—depending on your playbook. With meme stock culture still alive in 2025 and retail traders armed with Reddit, YouTube, and Discord, any of the names above could ignite at any moment.

Just remember: high short interest doesn’t guarantee upside—but it does guarantee fireworks.

💬 What Do You Think?

Are any of these on your radar? Which ticker do you think will pop next? Let us know in the comments below or tag us on social with your squeeze watchlist.

Be the first to comment