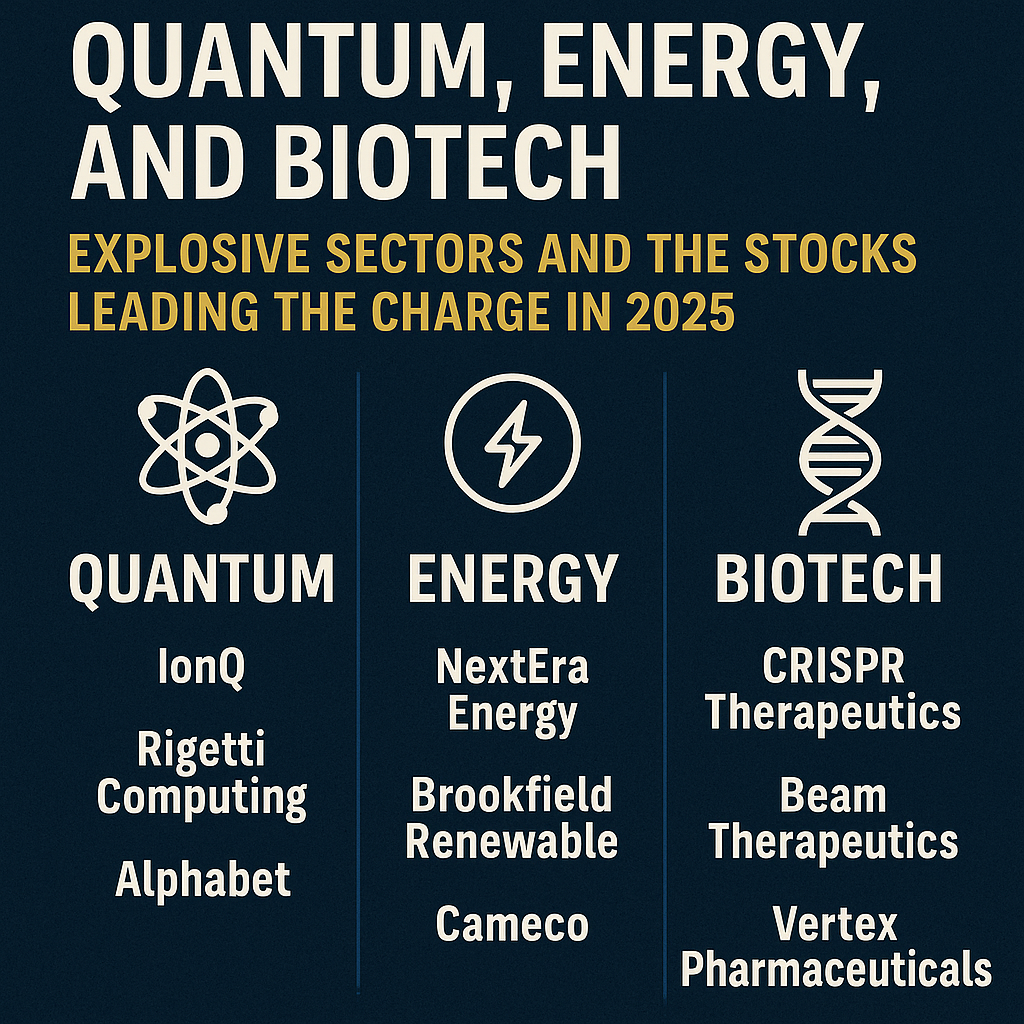

If you’re looking for stocks that could explode in 2025, three sectors are showing serious momentum: Quantum Computing, Energy, and Biotech. These aren’t speculative themes anymore—they’re rapidly maturing markets attracting billions in public and private capital.

In this post, we’ll explore why each of these sectors is poised for breakout growth, and which stocks are positioned to lead the charge. From futuristic computing to climate solutions and medical miracles, these areas offer real opportunities for bold investors in 2025.

Quantum Stocks: Investing in the Future of Computing

Quantum computing is making the leap from theory to real-world application. By processing complex calculations far faster than classical computers, quantum technology has the potential to revolutionize cryptography, drug discovery, and AI itself.

Top Quantum Stocks to Watch:

- IonQ (IONQ): A publicly traded pure-play quantum computing company using trapped ion technology. IonQ has landed key commercial partnerships and is increasing quantum volume each quarter.

- Rigetti Computing (RGTI): Focused on hybrid quantum-classical systems. Still early-stage, but active in defense and national research collaborations.

- Alphabet (GOOGL): Through its Quantum AI division, Google is investing heavily in superconducting quantum processors. While not a pure play, its R&D advantage is unmatched.

Quantum is still in its early innings—but that’s what makes it explosive. For investors, early exposure could mean asymmetric returns, especially as commercial use cases start to gain traction.

Energy Stocks: Riding the Green and Geopolitical Waves

The energy sector is at the center of global transformation. Climate policy, electrification, and national security concerns are reshaping how we generate and distribute power—and investors are chasing the companies leading this transition.

Top Energy Stocks to Watch:

- NextEra Energy (NEE): The largest U.S. renewable utility. With major solar and wind capacity, it’s a solid long-term bet on the clean energy economy.

- Brookfield Renewable (BEPC): Offers global diversification in hydro, solar, and wind assets. Known for strong yield and disciplined capital deployment.

- Cameco (CCJ): Uranium’s revival is real, and Cameco is positioned as the go-to name for nuclear energy supply as nations revisit nuclear for carbon-free baseload power.

As governments pour trillions into energy upgrades and climate solutions, renewables and nuclear alike are benefitting from an unprecedented policy tailwind.

Biotech Stocks: Innovation at the Speed of Science

Few sectors combine risk and reward like biotech. In 2025, innovation is accelerating thanks to AI-driven drug development, mRNA platform success, and breakthroughs in gene therapy. This makes biotech one of the most explosive and opportunity-rich spaces for investors.

Top Biotech Stocks to Watch:

- CRISPR Therapeutics (CRSP): Gene editing trailblazer with FDA-approved therapies and more in the pipeline. Partnered with Vertex to bring CRISPR-based medicine to the mainstream.

- Beam Therapeutics (BEAM): Specializing in base editing—an even more precise form of gene editing—with a strong pipeline and deep IP.

- Vertex Pharmaceuticals (VRTX): Offers revenue stability from its cystic fibrosis business while investing in pain and kidney disease innovation.

Biotech stocks can skyrocket on a single trial result or FDA decision. While risk is high, the upside in this space can be transformative for early believers.

Why These Sectors Are Poised to Outperform

These three sectors—Quantum, Energy, and Biotech—each benefit from massive global trends:

- Quantum computing promises to upend industries by solving problems today’s computers can’t touch.

- Energy is being transformed by decarbonization, grid modernization, and geopolitical realignment.

- Biotech is racing forward with scientific breakthroughs and accelerated FDA pathways.

Together, they represent the convergence of innovation, necessity, and investment—a formula for market-beating returns in 2025 and beyond.

Risks: The Other Side of Explosive Growth

Of course, explosive sectors come with real risks:

- Quantum stocks are often pre-revenue and speculative, with long commercialization timelines.

- Energy stocks face price volatility, regulatory changes, and technology execution risk.

- Biotech stocks are sensitive to trial outcomes, patent cliffs, and policy shifts.

The key? Diversify across categories, size your positions wisely, and focus on companies with real traction or strategic partnerships.

Conclusion: Future-Focused Investing for 2025

Quantum, energy, and biotech aren’t just trending, they’re transforming the global economy. Investors who get in now are positioning themselves on the ground floor of multi-decade growth stories.

Looking for stocks that will explode in 2025? These three sectors and the companies leading them offer some of the most exciting potential on the market.

Be the first to comment