AI isn’t just living in data centers — it’s moving out to the edge, powering cameras, sensors, and connected devices everywhere. From autonomous cars to smart factories and wearables, the AI Edge is the next frontier of real-time intelligence.

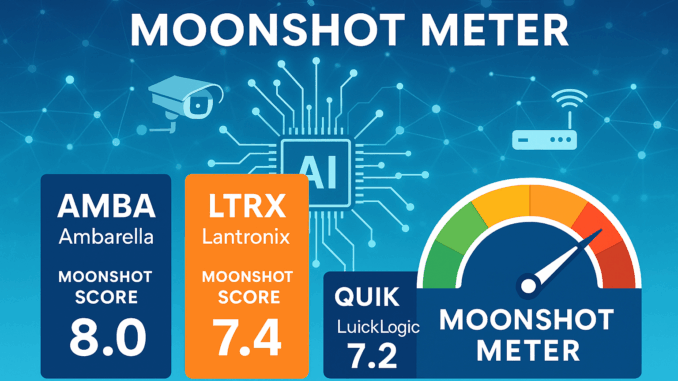

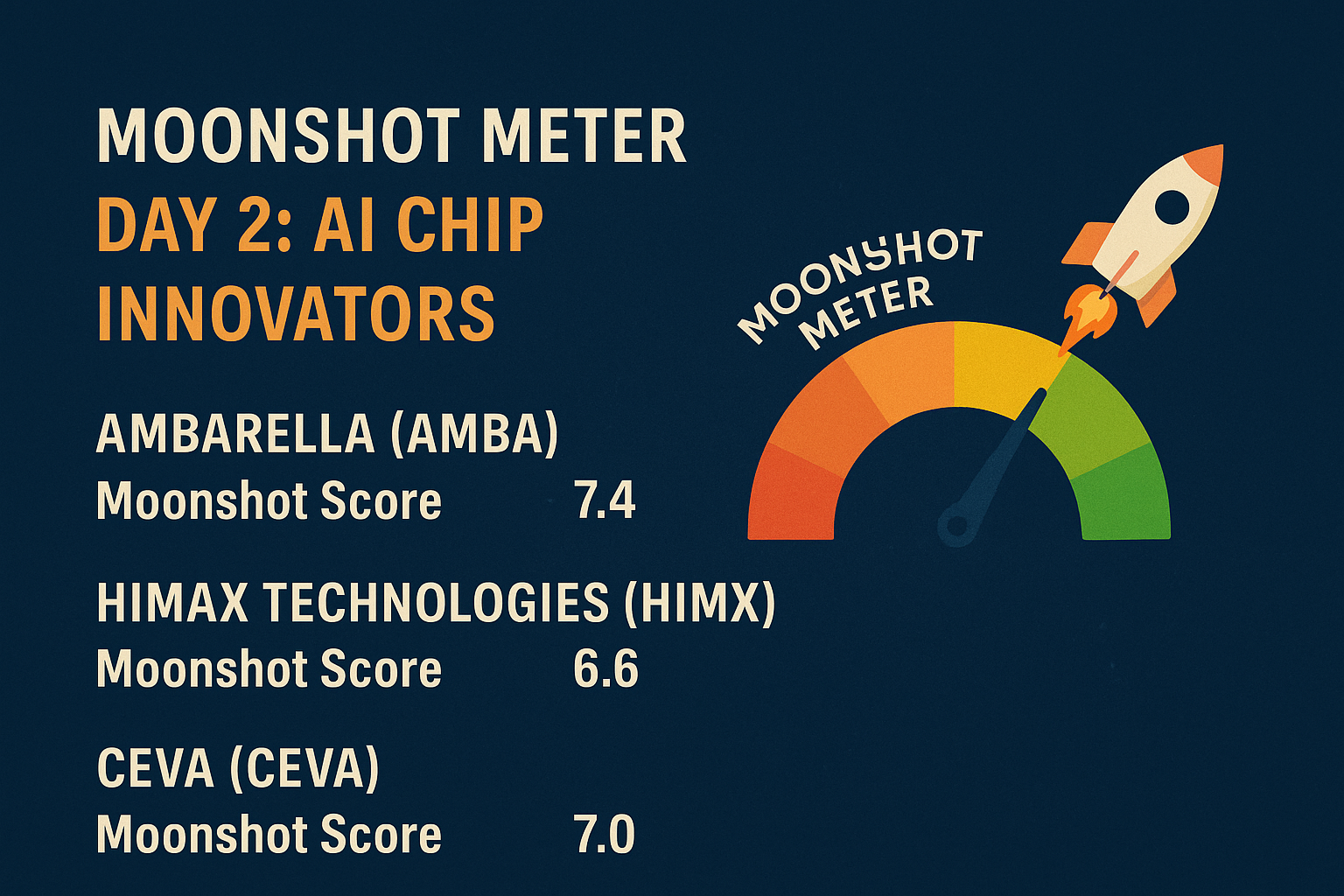

Today, we’re putting Ambarella (AMBA), Lantronix (LTRX), and QuickLogic (QUIK) on the Moonshot Meter.

🔹 Ambarella (AMBA)

Overview:

Ambarella designs AI processors and vision chips that enable edge devices — from drones and security cameras to cars — to process visual data locally instead of in the cloud. The company’s CVflow architecture and automotive partnerships make it one of the most important enablers of edge AI.

Moonshot Scores:

– Tech Breakthrough Potential: 9/10 – Leading AI-on-chip architecture.

– Market Opportunity: 9/10 – Edge vision demand growing across all industries.

– Commercialization Timeline: 9/10 – Already integrated in cameras, robotics, and automotive systems.

– Balance Sheet & Risk: 7/10 – Solid financials, still scaling profitability.

– Moonshot Torque: 6/10 – Mid-cap limits explosive upside but adds stability.

Final Moonshot Score: 8.0/10

Verdict: 🔹 High-Conviction Edge AI Innovator – A proven leader at the edge of AI vision and computing.

🌐 Lantronix (LTRX)

Overview:

Lantronix provides IoT connectivity and edge compute solutions that link smart devices to cloud networks securely. From industrial gateways to connected vehicles, it enables real-time data flow for companies deploying edge-based AI analytics.

Moonshot Scores:

– Tech Breakthrough Potential: 7/10 – Niche IoT and edge integration expertise.

– Market Opportunity: 8/10 – Growing industrial and smart infrastructure demand.

– Commercialization Timeline: 8/10 – Expanding product base with recurring service revenue.

– Balance Sheet & Risk: 5/10 – Small cap with moderate leverage.

– Moonshot Torque: 9/10 – Microcap with strong exposure to next-gen IoT adoption.

Final Moonshot Score: 7.4/10

Verdict: 🌐 Speculative IoT Moonshot – Risky, but positioned to capture industrial edge growth.

⚙️ QuickLogic (QUIK)

Overview:

QuickLogic develops low-power AI chips and FPGA solutions that accelerate edge inference, especially for wearables, voice assistants, and embedded systems. With open-source AI toolchains and partnerships across the sensor industry, it’s a true deep-tech microcap moonshot.

Moonshot Scores:

– Tech Breakthrough Potential: 8/10 – Unique open-source AI silicon approach.

– Market Opportunity: 8/10 – Expanding low-power AI and wearable markets.

– Commercialization Timeline: 6/10 – Early adoption, small-scale deployments.

– Balance Sheet & Risk: 4/10 – Thin margins and limited cash reserves.

– Moonshot Torque: 10/10 – Ultra-microcap with massive potential upside.

Final Moonshot Score: 7.2/10

Verdict: ⚙️ Speculative Microcap Moonshot – High-risk, high-reward deep-tech player in AI edge computing.

🧠 Why This Matters

The future of AI is distributed.

Instead of sending every piece of data to the cloud, tomorrow’s AI will think right where it’s needed — at the edge, in cars, cameras, and factories. These companies are building that frontier.

📝 Takeaway

Ambarella (AMBA): 🔹 High-Conviction Edge AI Innovator

Lantronix (LTRX): 🌐 Speculative IoT Moonshot

QuickLogic (QUIK): ⚙️ Speculative Microcap Moonshot

AI at the edge is where intelligence meets reality — and these three stocks are wiring that connection.

Be the first to comment