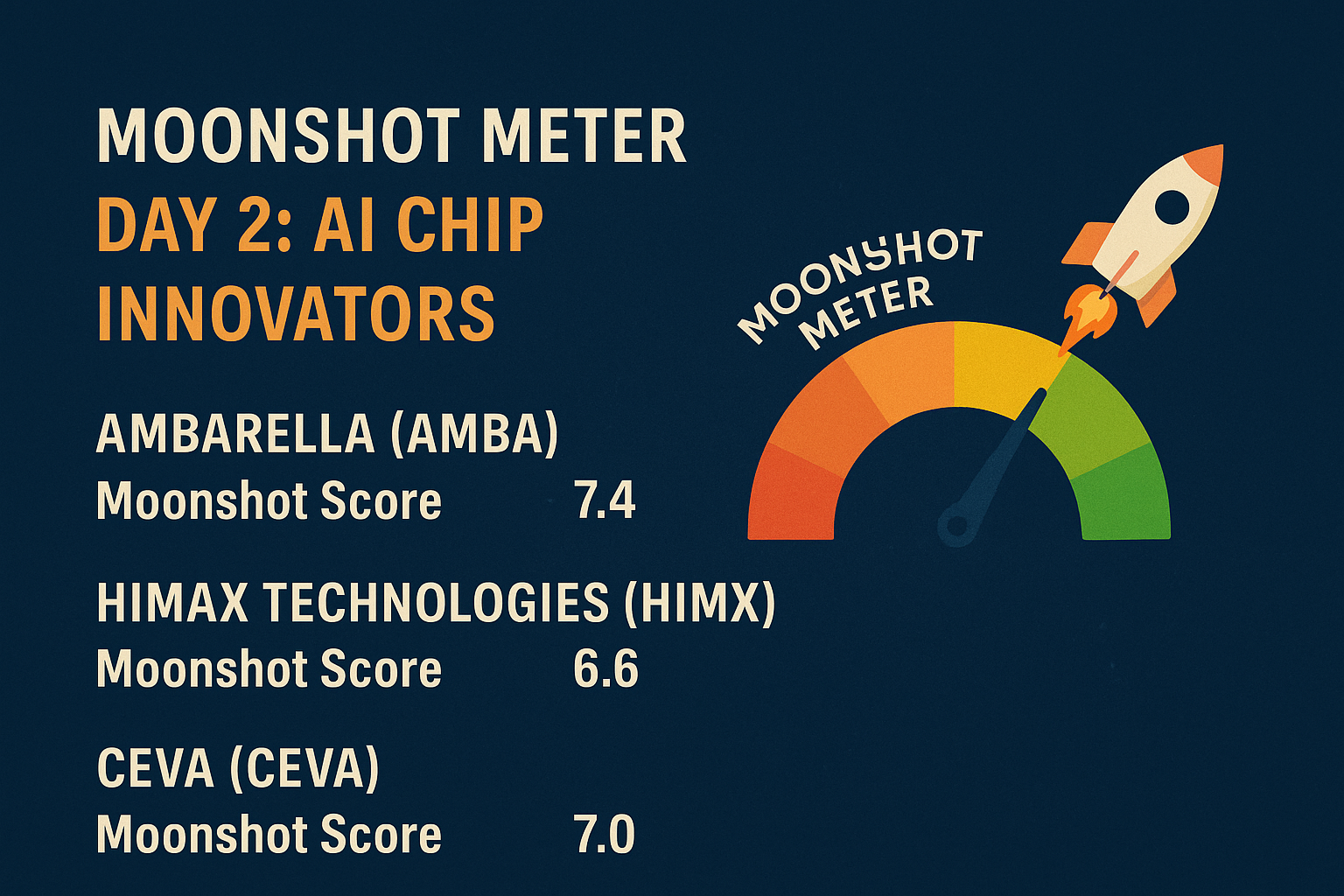

When people think AI chips, they think Nvidia — but there are plenty of smaller companies powering the edge, licensing AI IP, and enabling computer vision. These three stocks are under $10B market cap and could see explosive upside if their technologies gain traction. Let’s score them on the Moonshot Meter!

🔥 Ambarella (AMBA)

Overview:

Ambarella is a leader in edge AI vision processing, building low-power SoCs for automotive ADAS, robotics, and security cameras. As more AI inference happens at the edge, Ambarella’s role in computer vision becomes critical.

Moonshot Scores:

- Tech Breakthrough Potential: 8/10 – Leading player in edge AI vision chips.

- Market Opportunity: 8/10 – Strong tailwinds from robotics and autonomous vehicles.

- Commercialization Timeline: 7/10 – Revenue steady, but margins under pressure recently.

- Balance Sheet & Risk: 6/10 – Healthy cash balance, but cyclical demand can impact results.

- X-Factor: 8/10 – Multiple automotive design wins create a path for growth.

Final Moonshot Score: 7.4/10

Verdict: 🔥 High-Conviction Moonshot – One of the purest AI edge plays on the market.

🖼 Himax Technologies (HIMX)

Overview:

Himax is a fabless chipmaker specializing in display drivers and AI-enabled imaging solutions. Its work in AR/VR and automotive sensing tech gives it exposure to multiple fast-growing end markets.

Moonshot Scores:

- Tech Breakthrough Potential: 7/10 – Solid position in imaging, but niche focus.

- Market Opportunity: 7/10 – AR/VR, automotive, and IoT are attractive growth areas.

- Commercialization Timeline: 6/10 – Revenue diversification still in progress.

- Balance Sheet & Risk: 6/10 – Stable, but faces intense price competition.

- X-Factor: 7/10 – Key partnerships with major device makers could accelerate adoption.

Final Moonshot Score: 6.6/10

Verdict: ⚖️ Balanced Bet – Niche player worth watching for AR/VR adoption.

📡 CEVA (CEVA)

Overview:

CEVA licenses AI DSP cores, wireless IP, and sensor fusion technology to semiconductor companies, making it a pick-and-shovel play for edge AI. Its IP is used in smartphones, IoT devices, and automotive systems.

Moonshot Scores:

- Tech Breakthrough Potential: 7/10 – Strong IP portfolio, key enabler of edge AI.

- Market Opportunity: 8/10 – Billions of devices could use CEVA-powered AI inference.

- Commercialization Timeline: 7/10 – Licensing revenue already recurring and steady.

- Balance Sheet & Risk: 6/10 – Small cap volatility and competitive licensing environment.

- X-Factor: 7/10 – Strategic partnerships with tier-one semiconductor players.

Final Moonshot Score: 7.0/10

Verdict: ⚖️ Balanced Bet – Steady IP business, good indirect exposure to edge AI growth.

📝 Takeaway

This group represents AI’s quieter workhorses — not the mega-cap GPU makers, but smaller companies with real technologies and growth potential.

Moonshot Meter Call:

- 🔥 Ambarella (AMBA): High-Conviction Moonshot

- ⚖️ Himax Technologies (HIMX): Balanced Bet

- ⚖️ CEVA (CEVA): Balanced Bet

Be the first to comment