The SPAC world has a new headline-maker: Churchill Capital Corp X (CCCX) is merging with Infleqtion, a rising quantum technology company. This deal not only highlights the growing investor appetite for quantum computing and sensing, but it also sets up one of the most ambitious public listings in the sector. Let’s break down what it means, what the risks are, and why this deal matters.

What Is CCCX?

CCCX is a special purpose acquisition company (SPAC) created to take a private business public through a merger. As with most SPACs, it began life as a blank-check company with capital in trust and a mandate to identify a high-growth target. Its stock has traded in a typical SPAC range around $10–$13, but the upcoming deal with Infleqtion could be a game changer.

Who Is Infleqtion?

Infleqtion is a quantum technology company specializing in:

- Neutral-atom quantum computing — scalable hardware with high-fidelity entanglement.

- Quantum sensing — devices for navigation, gravity mapping, and RF detection.

- Atomic clocks — next-generation timekeeping with ultra-high precision.

- Space applications — work with NASA’s Cold Atom Lab and JPL gravity mapping missions.

Infleqtion claims over 1,600 physical qubits with 99.73% entangling fidelity and is targeting error-corrected logical qubits in the near future. Its roadmap includes a push toward 1,000 logical qubits by 2030, aiming for commercialization across computing and sensing markets.

The Deal Structure

Here are the key details of the announced merger:

- Valuation: $1.8 billion pre-money.

- Proceeds: More than $540 million expected, including a $125M PIPE from investors like Maverick Capital and Counterpoint Global.

- Listing: Post-merger, the combined company will trade under the ticker INFQ.

- Timeline: Closing expected in late 2025 or early 2026, subject to approvals and shareholder vote.

Share Conversion: CCCX to INFQ

One of the most common questions in SPAC deals is: what happens to my shares? Based on SEC filings and merger announcements, the answer here is straightforward:

Each share of CCCX Class A common stock will convert into one share of INFQ common stock at closing.

Warrants and units will also convert, but on formula-based terms. Sponsors and insiders have vesting conditions, but public shareholders can expect a simple 1-for-1 conversion.

Why This Deal Matters

This transaction matters for several reasons:

- Capital infusion: Quantum is capital-intensive, and this deal provides hundreds of millions in funding.

- Diversification: Infleqtion is not just about quantum computing—it has sensing, RF, and space applications.

- Investor backing: PIPE support from large institutions adds credibility.

- Industry growth: The quantum industry is projected to be a multi-billion-dollar opportunity, and public markets want exposure.

Risks to Consider

As exciting as this deal looks, there are real risks:

- Execution risk: Building error-corrected quantum computers is extremely challenging.

- Dilution: Redemptions and future funding rounds may dilute shareholders.

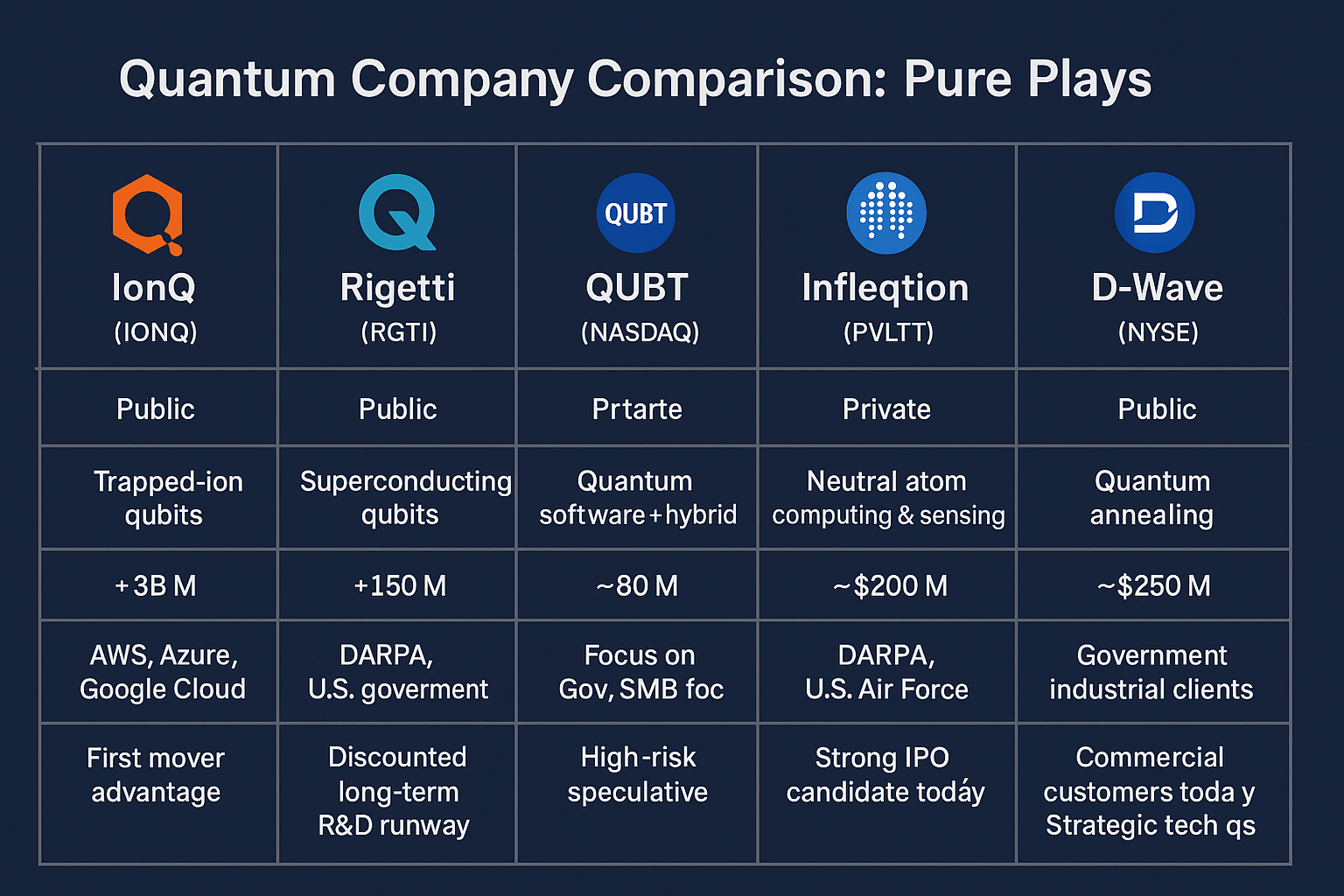

- Competition: Rivals like IonQ, Rigetti, and D-Wave are already public and scaling.

- Valuation pressure: At $1.8B valuation with ~$29M trailing revenue, Infleqtion will need to justify its price tag quickly.

What to Watch Next

- SEC review of the S-4/proxy statement.

- CCCX shareholder vote and redemption levels.

- PIPE funding confirmation.

- Progress on Infleqtion’s “Sqorpius” quantum roadmap.

- New partnerships or government contracts in defense and space.

Final Thoughts

The CCCX–Infleqtion deal is one of the boldest SPAC transactions of 2025. If it closes successfully, Infleqtion will become one of the most high-profile publicly traded quantum companies. The opportunity is huge, but so are the risks. For investors, this is a high-stakes bet on the future of quantum computing and sensing technology.

Be the first to comment