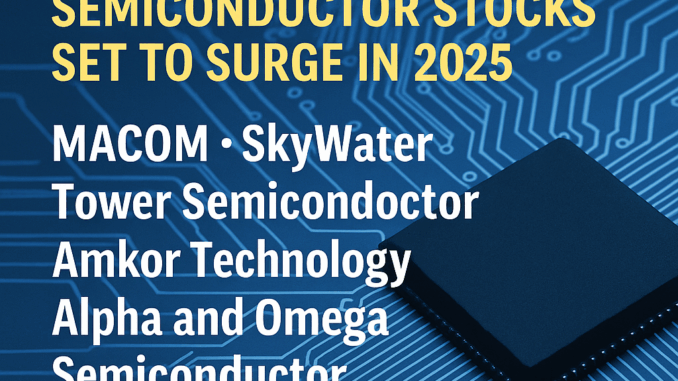

When it comes to investing in semiconductors, names like NVIDIA, AMD, and TSMC tend to dominate the headlines—and the portfolios. But what if the biggest growth potential in 2025 isn’t in the usual suspects? As demand for chips expands into AI, 5G, autonomous vehicles, and data centers, a handful of undervalued semiconductor stocks are flying under the radar with massive upside.

These aren’t the flashy mega-caps. Instead, they’re specialized companies focused on high-growth niches like analog, packaging, RF, and foundry services—some of the most critical yet overlooked areas in the chipmaking ecosystem. If you’re hunting for value in the semis, these are the stocks you should be watching now.

1. MACOM Technology Solutions (MTSI): A Quiet Force in RF and Data Center Expansion

MACOM may not be a household name, but it plays a vital role in enabling next-gen networking and data infrastructure. The company designs semiconductors for RF, microwave, and optical applications that support 5G, high-speed internet, and cloud growth.

With strong positioning in the data center and telecom sectors, MACOM is benefiting from surging bandwidth demand. Its recent acquisitions have expanded its product lines while maintaining profitability. At a time when data usage is exploding, MTSI offers exposure to critical backbone technologies—without the inflated valuations.

2. SkyWater Technology (SKYT): The U.S. Foundry With Strategic Significance

SkyWater is one of the only U.S.-based semiconductor foundries, and that makes it incredibly important in a world focused on supply chain resilience and domestic chip production. The company partners with government agencies and commercial clients to produce custom chips for aerospace, defense, healthcare, and automotive applications.

While still small-cap, SkyWater is positioned to benefit from U.S. federal investments under the CHIPS Act and rising demand for secure, localized fabrication. Investors looking for long-term growth tied to national infrastructure and specialty manufacturing should keep SKYT on their radar.

3. Tower Semiconductor (TSEM): Analog Powerhouse With Global Reach

Tower Semiconductor specializes in analog and mixed-signal chips, which are critical to sensors, power management, and signal processing. While not as glamorous as AI chips, analog semiconductors are essential to nearly every modern electronic device—and Tower excels in this space.

The company was previously in acquisition talks with Intel, which shows how strategically valuable it is. Even after that deal was called off, Tower continues to grow through strategic partnerships and expansion across Asia and Europe. TSEM is an international chipmaker with steady earnings and a moat in a vital semiconductor niche.

4. Amkor Technology (AMKR): The Back-End Giant You’ve Probably Overlooked

Amkor is a leader in semiconductor packaging and testing, two stages of the chipmaking process that are becoming more critical as chip complexity increases. The move toward advanced packaging solutions—like chiplets and 3D stacking—plays directly into Amkor’s strength.

With clients ranging from smartphone giants to AI chip designers, Amkor is expanding operations in Korea, Vietnam, and Portugal. Its role as a third-party packager for fabless companies gives it a high-demand, low-risk business model. For investors seeking exposure to the rise of high-performance chips, AMKR is a compelling bet.

5. Alpha and Omega Semiconductor (AOSL): Quietly Powering the Electrification Era

AOSL makes power semiconductors used in electric vehicles, solar inverters, motor controllers, and consumer devices. As the global economy shifts toward electrification and energy efficiency, demand for AOSL’s components is increasing rapidly.

The company has strong fundamentals, low debt, and trades at a discount to industry peers despite its long-term tailwinds. AOSL’s high insider ownership also signals confidence from leadership. For investors looking for a pure play on power management and electrification, AOSL is an undervalued gem.

Conclusion: Where the Smart Tech Investors May Look Next

These five semiconductor stocks—MACOM, SkyWater, Tower, Amkor, and Alpha and Omega—don’t grab headlines like NVIDIA, but they represent critical pieces of the chip supply chain. Each operates in a niche poised for strong growth in 2025 and beyond, whether it’s RF chips for data centers, domestic foundries for defense, or power components for EVs.

If you’re tired of chasing overpriced tech giants and want exposure to semiconductor stocks with real upside, it might be time to look in the shadows. These under-the-radar names could be your portfolio’s next breakout performers—before Wall Street catches on.

Be the first to comment