Quantum computing is no longer confined to academic labs and government projects—it’s making its way to Wall Street. A handful of pure play quantum companies are now publicly traded, while others remain private but are edging closer to IPOs. For investors, the question isn’t whether quantum will be disruptive—it’s which stocks are best positioned to benefit.

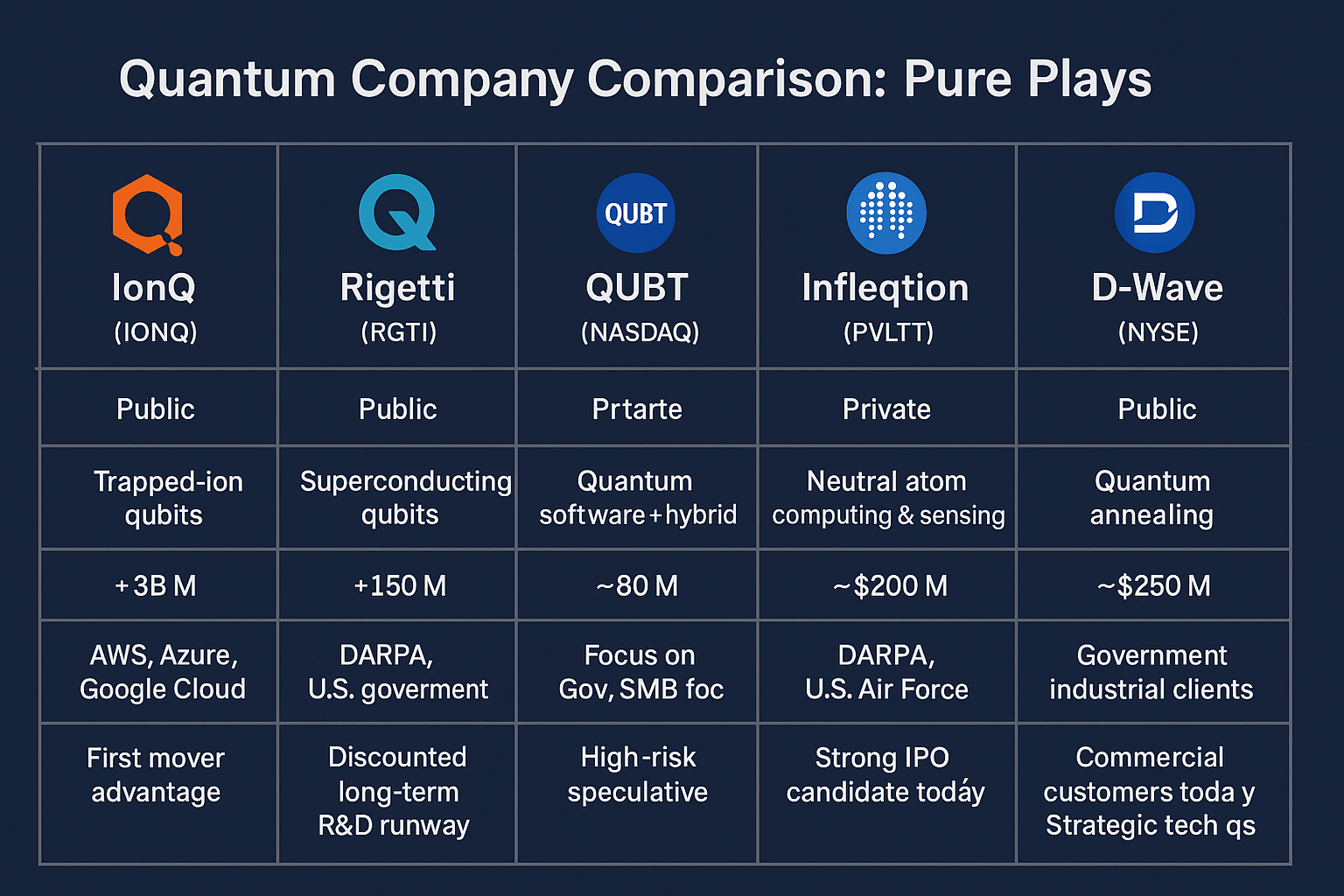

This article compares the top pure play quantum companies—IonQ, Rigetti, QUBT, Infleqtion, and D-Wave—highlighting their strengths, weaknesses, and potential.

The Pure Play Advantage

Unlike diversified tech giants (Google, IBM, Microsoft), pure play quantum companies focus almost exclusively on quantum hardware, software, or applications. That focus gives them an edge in innovation and branding but also exposes them to higher volatility and risk.

Company Profiles

IonQ (NYSE: IONQ)

- Technology: Trapped-ion quantum computers

- Market Cap: ~$3 billion (2025)

- Strengths: First-mover advantage, deep partnerships with Amazon AWS, Microsoft Azure, and Google Cloud.

- Risks: Stock has been highly volatile; commercialization is still early.

- Investor Takeaway: The best-known quantum pure play, but priced with high expectations.

Rigetti Computing (NASDAQ: RGTI)

- Technology: Superconducting qubits

- Market Cap: ~$150 million (2025)

- Strengths: Experienced engineering team, U.S. government and DARPA contracts.

- Risks: SPAC hype collapsed, valuation dropped dramatically. Struggles with scaling.

- Investor Takeaway: Deeply discounted, but a long R&D runway remains.

Quantum Computing Inc. (NASDAQ: QUBT)

- Technology: Quantum software and hybrid classical/quantum solutions

- Market Cap: ~$80 million (2025)

- Strengths: Software-first approach, lower capital intensity than hardware peers.

- Risks: Extremely volatile, thin financials, and speculative.

- Investor Takeaway: A high-risk, small-cap bet for aggressive investors only.

Infleqtion (formerly ColdQuanta)

- Technology: Neutral atom quantum computers & quantum sensors

- Funding: $200M+ raised privately

- Strengths: Dual focus on computing + sensing, DARPA and U.S. Air Force contracts.

- Risks: Still private, so retail investors can’t buy in yet; scaling hardware remains challenging.

- Investor Takeaway: A strong IPO candidate. Watch closely for public debut.

D-Wave Quantum (NYSE: QBTS)

- Technology: Quantum annealing (optimization-focused)

- Market Cap: ~$250 million (2025)

- Strengths: The first company to sell commercial quantum systems; decades of experience in quantum annealing.

- Risks: Annealing is less flexible than gate-based quantum computing; some debate on its scalability and long-term relevance.

- Investor Takeaway: The most commercially advanced in terms of customer use cases, but faces a strategic challenge as gate-based approaches mature.

Side-by-Side Comparison

| Company | Status | Core Technology | Market Cap / Funding | Key Partnerships & Customers | IPO / Growth Outlook |

|---|---|---|---|---|---|

| IonQ (IONQ) | Public (NYSE) | Trapped-ion qubits | ~$13B | AWS, Azure, Google Cloud | First mover; volatile |

| Rigetti (RGTI) | Public (NASDAQ) | Superconducting qubits | ~$5.35B | DARPA, U.S. gov, cloud | Discounted, long-term R&D |

| QUBT | Public (NASDAQ) | Quantum software + hybrid | ~$2.6B | Gov & SMB focus | High-risk speculative |

| Infleqtion | Private | Neutral atom computing & sensing | $200M+ raised SPAC 2026 | DARPA, U.S. Air Force | Strong IPO candidate |

| D-Wave (QBTS) | Public (NYSE) | Quantum annealing | ~$5.52B | Government, industrial clients | Commercial customers today, but strategic tech questions remain |

The Verdict

- For Visibility: IonQ remains the “face” of pure play quantum stocks.

- For Value Hunters: Rigetti is deeply discounted but still working on scaling.

- For Speculators: QUBT offers volatility (and risk) in spades.

- For the Future: Infleqtion could be the next IPO, bringing neutral atom tech to Wall Street.

- For Practical Use Today: D-Wave has real commercial deployments, but faces questions about whether annealing can compete with universal gate-based approaches.

Quantum computing isn’t a short-term trade—it’s a long-haul revolution. But investors who track these pure plays early may be well positioned when the sector finally makes the leap from promise to profits.

Be the first to comment