In a year when tech and energy stocks have battled for investor attention, Power Solutions International (NASDAQ: PSIX) has quietly surged over 1,200% year-to-date, making it one of the most dramatic under-the-radar moves of 2025. Specializing in power systems that support everything from data centers to commercial vehicles, PSIX is attracting buzz from retail investors and analysts alike. But the question remains, is this stock truly undervalued, or has hype outpaced reality? This deep dive into PSIX’s financials and strategic outlook aims to help investors separate facts from FOMO.

What Does Power Solutions International Actually Do?

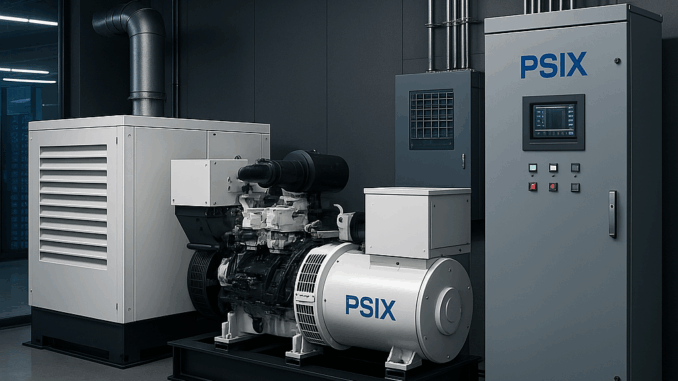

Power Solutions International designs, engineers, and manufactures advanced, emission-certified power systems fueled by natural gas, propane, and gasoline. These systems serve mission-critical applications, including backup power for data centers, power generation for industrial sites, and clean-energy transportation solutions. In a world rapidly shifting toward cleaner, distributed power models, PSIX’s technology sits at the intersection of legacy infrastructure and the green transition. The company has quietly built momentum through contracts with key industrial and tech players, even as it’s remained relatively obscure compared to major cleantech names.

Financials Tell the Tale

On paper, PSIX looks compelling. The company is trading at a P/E ratio of just 12.9x, compared to an industry average north of 23x. This suggests investors may be undervaluing its earnings power. Recent financials show healthy revenue growth with increasing gross margins and a clear path toward sustained profitability. In its latest quarterly report, PSIX posted solid revenue growth, driven by strong demand in the data center and power generation segments. Importantly, the company has shown discipline in managing its debt and appears to be on stable financial footing, even as it scales operations.

Growth Catalysts Powering the Stock

One of the most exciting drivers behind PSIX’s rally is its exposure to high-growth verticals like grid-resilient backup systems for data centers, microgrids, and alternative fuel vehicle fleets. With energy reliability becoming a national priority, PSIX’s solutions are in demand. Additionally, the company is exploring new applications in distributed power and smart microgrid development, both of which align with clean energy investment trends and infrastructure funding initiatives. PSIX’s technology also integrates well with hybrid and hydrogen platforms, positioning it for future adaptation as energy tech evolves.

Power Solutions International Risks

Of course, no deep dive is complete without addressing the risks and PSIX has its fair share. Despite impressive returns, the stock remains highly volatile, and its massive year-to-date rally raises concerns about short-term overbought conditions. The company also relies on a limited number of large customers, making it vulnerable to contract losses. Moreover, while natural gas is cleaner than diesel, it’s still a fossil fuel. Thus, this potentially limits PSIX’s ESG appeal compared to fully renewable players. Add in competitive pressures from better-capitalized giants and the margin for error narrows quickly.

Largely Unknown

Although PSIX doesn’t get as much Wall Street coverage as blue-chip names, sentiment has been cautiously optimistic. The few analysts covering the stock forecast 11.6% annual earnings growth, underpinned by strong demand and cost efficiencies. Technical indicators suggest the stock has entered a new support range, and institutional interest is quietly rising. That said, many analysts also flag the potential for retracement if broader market conditions tighten or if PSIX fails to meet its next few quarters of earnings expectations.

Conclusion: Is it Undervalued or Overhyped?

So, is PSIX undervalued or overhyped? Based on fundamentals, it’s hard to ignore the value proposition: strong earnings, growing revenue, strategic positioning in future-facing sectors, and a relatively low valuation. However, the magnitude of its recent price movement suggests that short-term sentiment may be running hotter than the long-term fundamentals alone justify. For long-term investors with a high risk tolerance, PSIX may offer a compelling opportunity, but just be ready for turbulence. Sometimes the best value stocks are the ones nobody’s talking about yet.

Be the first to comment